The Ripple Effect of Economic Uncertainty

During election years, the real estate market often experiences a phenomenon known as the “election effect.” But what exactly does this mean for buyers and sellers?

Election years typically bring a cloud of economic uncertainty. As voters ponder the potential changes in leadership, policies, and regulations, this uncertainty can lead to a temporary slowdown in market activity. Buyers and sellers may adopt a “wait-and-see” approach, causing a brief pause in transactions.

However, it’s important to note that this effect is often short-lived. Historical data shows that while there might be a slight dip in activity leading up to the election, the market tends to rebound quickly once the results are in, regardless of the outcome.

Interest Rates: The Election Connection

One of the most significant ways presidential elections can impact the real estate market is through their influence on interest rates. But how exactly does this work?

Presidential candidates’ economic policies can signal potential changes in fiscal policy, which may impact interest rates. For instance, a candidate favoring increased government spending might lead to concerns about inflation, prompting the Federal Reserve to raise interest rates.

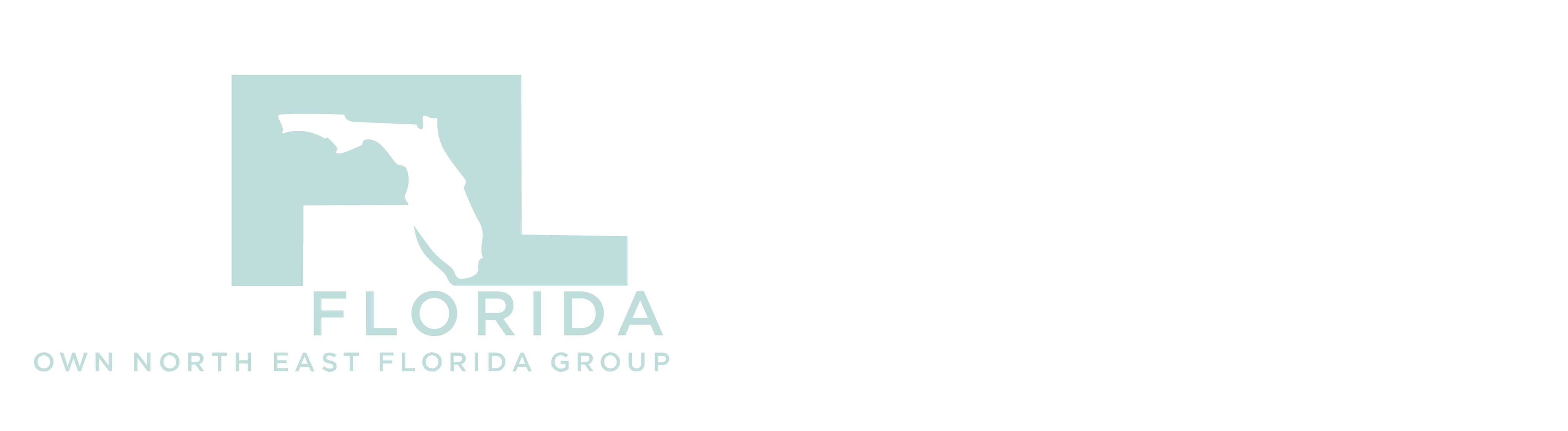

Interestingly, data from Freddie Mac reveals a surprising trend: mortgage rates have historically decreased slightly from July to November in 8 of the last 11 presidential elections.

This trend suggests a temporary easing in borrowing costs leading up to the election, which could encourage more buyers to enter the market.

Tax Policies: A Double-Edged Sword

Tax policies proposed by presidential candidates can have far-reaching effects on the real estate market. Changes in capital gains tax, property tax deductions, and overall tax rates can significantly influence real estate investment decisions.

For example:

- Reducing property tax deductions could dissuade potential buyers, especially in high-tax areas.

- Favorable tax policies for real estate investments could boost market activity.

- Changes in capital gains taxes could impact how investors approach property sales.

Consumer Confidence: The Psychological Factor

Never underestimate the power of perception in the real estate market. Consumer confidence plays a crucial role in driving market activity, and presidential elections can significantly influence how confident people feel about the economy’s future.

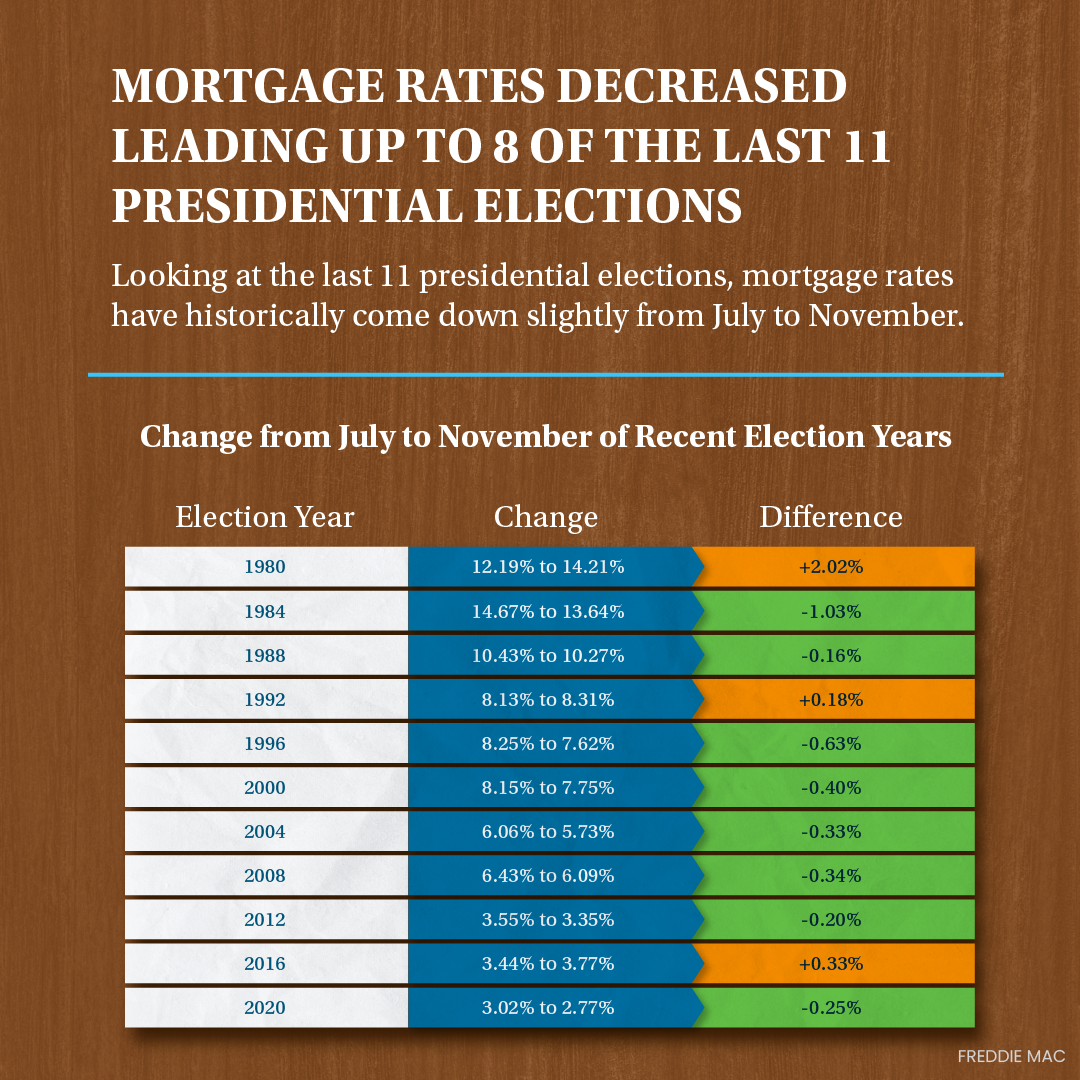

Historical data from HUD and NAR shows an interesting pattern: home sales tend to slow down slightly in November of election years but often rebound and climb the following year.

This pattern suggests that while there may be a temporary dip in market activity, the overall trend remains positive post-election.

The Current Market: Navigating Uncharted Waters

The 2024 election year presents a unique scenario for the real estate market. Unlike previous election years, we’re navigating unprecedented circumstances, including the lingering effects of a global pandemic and significant economic shifts.

Inflation: The Wild Card

Inflation has emerged as a major factor influencing the current real estate landscape. Rising costs of goods and services, coupled with potential interest rate hikes, are creating a complex environment for both buyers and sellers.

- For Buyers: Inflation can erode purchasing power, making it more challenging to afford homes.

- For Sellers: While high home prices might seem advantageous, they also face the challenge of finding their next property in an inflated market.

Supply and Demand Dynamics

Despite these challenges, the market remains resilient due to a fundamental imbalance:

- Strong demand from buyers eager to lock in still-historically low interest rates

- Limited inventory of available homes, keeping prices elevated

This dynamic has created a competitive market, with many areas seeing multiple offers and quick sales.

Looking Ahead: Post-Election Predictions

While it’s impossible to predict the future with certainty, we can make some educated guesses about the post-election real estate market:

- Short-term volatility: Expect some market fluctuations immediately following the election as the market absorbs the results.

- Policy impact: Keep an eye on the new administration’s policies regarding housing, taxes, and economic stimulus, as these can significantly influence the market.

- Regional variations: Remember that national trends may not reflect your local market. Work with a local real estate expert to understand your specific market conditions.

Conclusion: Your Action Plan

As we navigate this election year, here are some key takeaways for real estate decisions:

- Stay informed: Keep up with both national trends and local market conditions.

- Don’t let fear drive decisions: While elections can cause short-term uncertainty, the real estate market has historically remained resilient.

- Think long-term: Real estate is typically a long-term investment. Consider your personal goals and financial situation above short-term market fluctuations.

- Work with experts: Partner with experienced real estate professionals who can provide guidance tailored to your specific situation and local market.

Remember, whether you’re buying, selling, or investing, the key to success in any market is being well-informed and prepared. At O.N.E. Florida Group, we’re here to help you navigate these complex times and make the best decisions for your real estate goals.

Email Us for a Personalized Consultation

Version 4 of 5