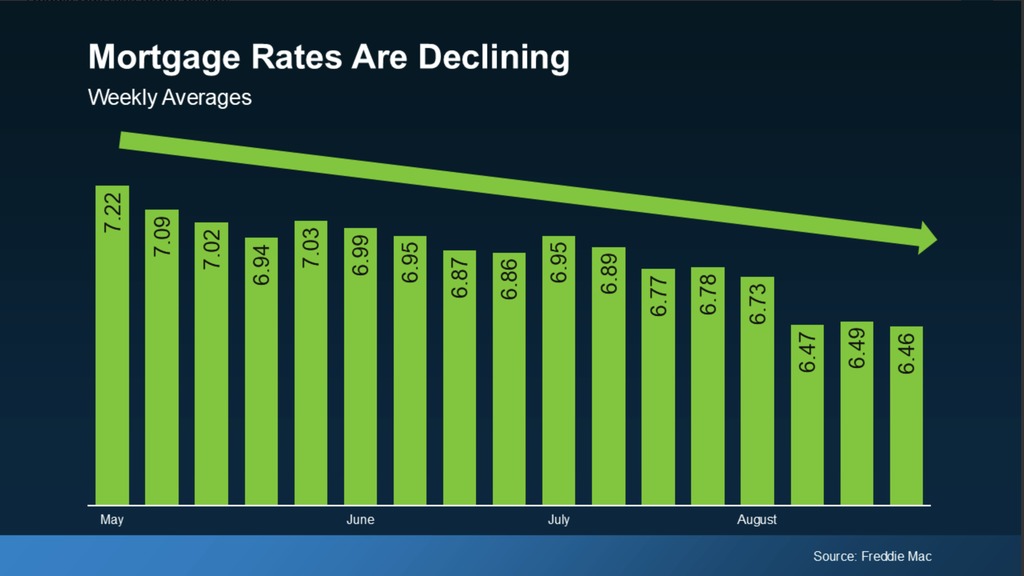

Why the Sudden Drop in Mortgage Rates?

Recent revelations have shaken the economic landscape. The Federal Reserve, in a somewhat surprising acknowledgment, is now considering rate cuts. Why? Because those job reports we’ve been banking on? They were off by a staggering 800,000 jobs. This miscalculation suggests that the economy isn’t as robust as we were led to believe, hinting that rates should’ve been lowered a while ago. This oversight has kept rates artificially high, squeezing the housing market and your wallet.

Expert Predictions on Mortgage Rates

With inflation cooling and these new economic indicators, experts are revising their forecasts. They’re now whispering, if not outright predicting, that we could see rates in the low 6s. Realtor.com, for instance, has adjusted its year-end forecast down to 6.3% from 6.5%, betting on the Fed’s next moves being towards rate cuts.

Your Personal Mortgage Rate Calculator

Here’s where it gets interactive and personal. We’re soon adding a feature where you can calculate the best time to refinance or jump into the housing market based on your financial comfort zone. This tool will help you decide when the rates align with your personal threshold for action.

Setting Your Mortgage Rate Target

So, what’s your magic number? Is it when rates hit 6.25%? Or maybe you’re waiting for that sub-6% sweet spot? Identifying this number is crucial. Once you’ve got it, don’t just sit by your computer refreshing rate updates. Connect with a real estate pro. They’ll keep an eagle eye on the market for you, alerting you the moment your target rate becomes reality.

The Broader Economic Impact on Mortgage Rates

This isn’t just about numbers; it’s about the broader economic narrative. The current administration’s policies, coupled with an overzealous fight against inflation, have arguably kept rates higher than necessary. This has not only hurt housing affordability but has also painted an overly optimistic picture of job growth, which we now know was significantly overestimated.

Is Now the Time to Buy or Refinance?

If you’ve been sidelined by the high mortgage rates, now’s the time to reassess. With rates dropping and the economic indicators suggesting more cuts could be on the horizon, setting your rate target and preparing to act could place you ahead in the housing game. Remember, in the world of real estate, timing isn’t everything, but it’s a big something. So, let’s get you ready to make your move when the time is just right.

Ready to take advantage of these falling rates? Contact us today to discuss your home buying or refinancing options.