When it comes to determining the value of a property, homeowners and buyers have several options at their disposal. Two of the most popular methods include using an automated home valuation tool and obtaining a Comparative Market Analysis (CMA) from a Realtor. While both can provide a general idea of a property’s worth, the accuracy and reliability of these methods may vary.

In this blog, we will explore the differences between automated home valuation tools and Realtor CMAs, and discuss the accuracy of both approaches.

Automated Home Valuation Tools

Automated home valuation tools, also known as AVMs (Automated Valuation Models), are online tools that provide an instant estimate of a property’s value based on mathematical models, algorithms, and available data. These tools utilize public records, recent sales data, and market trends to generate their estimates. Some popular examples of AVMs include Zillow’s Zestimate and Redfin’s Estimate.

Pros:

- Convenience: Automated home valuation tools are quick and easy to use, as they provide instant results with just a few clicks.

- Free access: Most AVMs are available for free, making them a cost-effective way to obtain an initial property value estimate.

Cons:

- Limited data: AVMs rely on public records and data, which may not always be up-to-date or accurate.

- Lack of local expertise: Automated valuation tools don’t account for local market nuances, as they are designed to provide a broad estimation based on a wide range of data.

- Generic algorithms: The algorithms used by AVMs are often generic and may not take into consideration specific factors that could influence a property’s value, such as unique features, improvements, or potential issues.

ONEFLORIDAGROUP.COM INSTANT VALUATION TOOL

TRY IT OUT, CHECK OUT OUR AVM TOOL AND GET A FREE INSTANT HOME VALUATION

Realtor Comparative Market Analysis (CMA)

A Comparative Market Analysis, or CMA, is a detailed report prepared by a Realtor to estimate a property’s value. CMAs consider various factors, including the property’s condition, location, and features, as well as recent sales and listings of comparable properties in the area. Realtors use their local market knowledge and expertise to provide a more accurate and personalized estimation of a property’s worth.

Pros:

- Local expertise: Realtors possess in-depth knowledge of the local market and are familiar with factors that could influence a property’s value.

- Comprehensive analysis: CMAs take into account a wide range of factors, such as property condition, improvements, and unique features, to provide a more accurate estimation.

- Personalized approach: A Realtor can tailor their analysis to meet the specific needs and concerns of a client, ensuring that the CMA is relevant and useful.

Cons:

- Time-consuming: Obtaining a CMA can be a longer process compared to using an automated valuation tool, as it requires the Realtor to conduct research and compile the report.

- Cost: While some Realtors may provide a CMA for free, others may charge a fee for this service (O.N.E. FLORIDA GROUP CMA’S ARE ALWAYS FREE OF CHARGE)

COMPARE FOR YOURSELF, GET A FREE COMPARATIVE MARKET ANALYSIS FROM ONE OF OUR AGENTS

GET FREE COMPARATIVE MARKET ANALYSIS

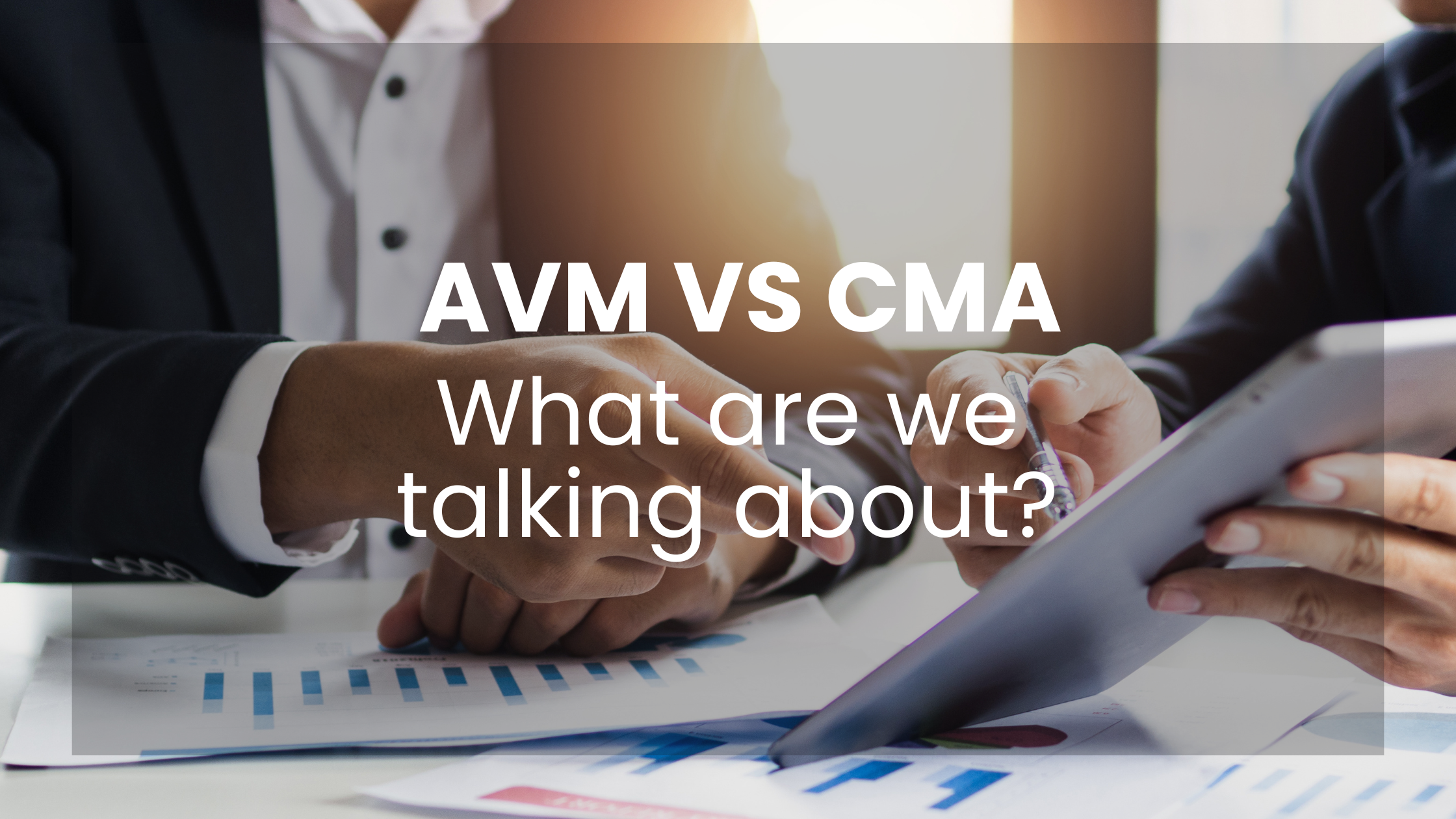

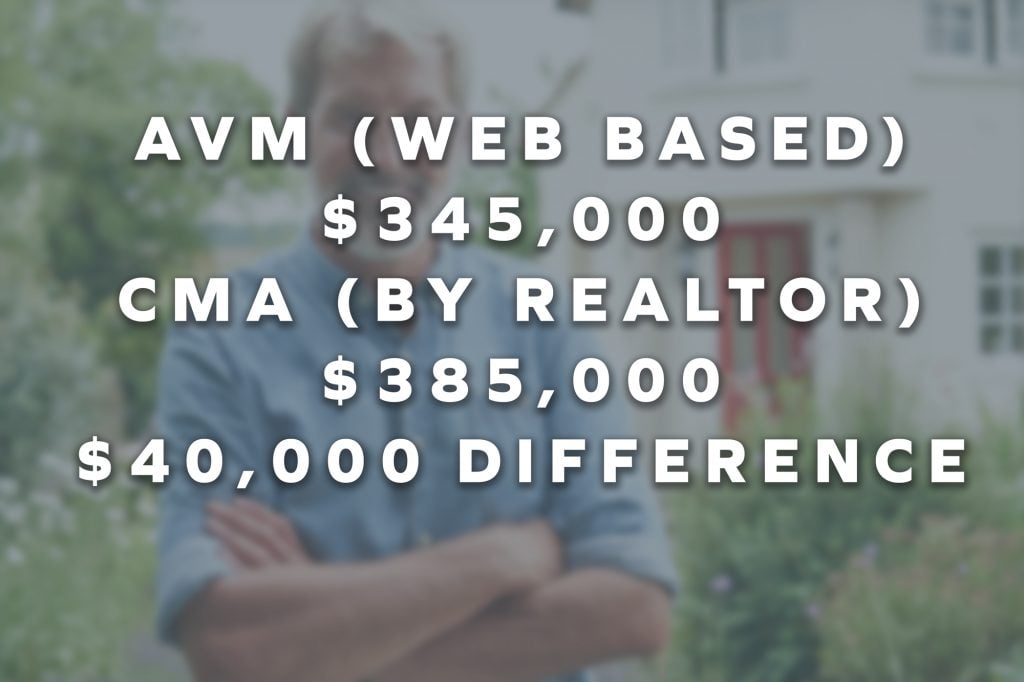

LETS SEE AN EXAMPLE

Meet John, a homeowner in North East Florida who is considering selling his 4-bedroom, 3-bathroom property. To get an idea of its value, John decides to use both an Automated Valuation Model (AVM) and obtain a Comparative Market Analysis (CMA) from a local Realtor.

Step 1: Using an AVM

John visits a popular AVM website, such as Zillow or Redfin, and enters his property address. The AVM quickly provides an estimated value of $345,000 for his home. This estimation is based on public records, recent sales data, and market trends in John’s area. However, John realizes that the AVM might not take into account some recent upgrades he made to his property, including a new roof, a remodeled kitchen, and updated landscaping.

Step 2: Requesting a CMA from a Realtor

John contacts Jane, a local Realtor, and requests a Comparative Market Analysis for his property. Jane visits John’s home to assess its condition, unique features, and improvements, such as the new roof and remodeled kitchen. She also researches comparable properties that have recently sold or are currently listed in John’s neighborhood.

After carefully analyzing the information, Jane provides John with a detailed CMA report, which estimates the value of his property at $385,000. This valuation accounts for the upgrades John made to his home, as well as Jane’s knowledge of the local market and the desirability of the neighborhood.

Comparing Results: AVM vs. CMA

In this example, the AVM provided an estimated value of $345,000, while the CMA from the Realtor estimated the property value at $385,000. The CMA is likely to be more accurate for several reasons:

- The CMA takes into account the specific upgrades and improvements John made to his property, which the AVM may not have considered.

- Jane, the Realtor, has in-depth knowledge of the local market in Northeast Florida and can factor in market nuances that the AVM might not capture.

- The CMA includes a more comprehensive analysis of comparable properties in the neighborhood, providing a more accurate estimation of the property’s value.

In this example, John discovers that the CMA provided by his Realtor is likely to be MUCH more accurate than the AVM’s estimation. By obtaining both an AVM and a CMA, John can make a more informed decision about his property’s worth and set a competitive listing price when he decides to sell his home.

Accuracy of Both Methods

While automated home valuation tools can provide a quick and convenient estimate of a property’s value, their accuracy can be affected by limited data, generic algorithms, and a lack of local expertise. On the other hand, a Realtor CMA tends to be more accurate due to its comprehensive analysis and the local knowledge of the Realtor. However, it’s important to remember that even CMAs can vary in accuracy depending on the skill and experience of the Realtor.

Ultimately, both automated home valuation tools and Realtor CMAs have their advantages and limitations. For homeowners or buyers seeking a quick, initial estimate, an AVM might be a suitable option. However, for those who require a more in-depth and accurate analysis, a Realtor CMA is likely the better choice. It’s important to note that neither method can provide a definitive property value, as the actual value of a property is determined by what a buyer is willing to pay and what a seller is willing to accept. As a best practice, consider using both methods as complementary tools to gain a well-rounded understanding of a property’s worth.